Auction results are usually the only public data available for reading the art market, even though they reflect only the secondary sphere. Art fair sales reports can hint at how the primary market is behaving and what collectors are circling, but even those numbers are unstable, shaped by discounts, negotiations and the many variables that can shift between an invoice being issued and a wire arriving. Artsy, widely regarded as the largest online marketplace for art, recently released its first Buyer Trends Report based on the searches and primary-market transactions on its platform, offering a clearer picture of what collectors were buying in 2025.

“This report reinforces the patterns we identified in Artsy’s Art Market Trends 2025: collectors are becoming more selective, and that discipline is directing demand toward the primary market—especially mid-tier and emerging artists,” Artsy CEO Jeffrey Yin told Observer, noting that works priced under $10,000 are benefiting as buyers look for strong entry points that do not rely on speculation. “Even as the top end recalibrates, the fundamentals remain healthy. People are acquiring art they genuinely want to live with, at price points that feel responsible in today’s market.”

Trend 1: Smaller paintings at smaller prices

Small paintings have dominated recent gallery shows and fairs, particularly on the emerging side. Pocket-sized works encourage a more intimate and emotional relationship with the subject, but they are also easier to live with—lighter to ship, simpler to frame and far less punishing when it comes to storage or relocation. In cities like New York and London, where aggressive real estate markets make long-term leases a luxury, collectors are increasingly opting for art that can move with them.

Artsy’s users in 2025 were actively seeking art on a micro scale, with searches for “micro,” “mini” and “small” rising 40 percent, 47 percent and 49 percent. Forty percent of all purchases on the platform were for small works, and acquisitions tagged as “miniature and small-scale paintings” increased 66 percent year over year.

These numbers may be predictable for an online marketplace, where buyers tend to trust digital transactions for lower price tiers rather than multimillion-dollar blue-chip masterpieces that require in-person due diligence. Still, the pattern aligns with the 2025 Art Basel & UBS Art Market Report, which noted that while the highest-end segment contracted sharply (sales above $10 million fell steeply in both number and total value), works priced below $50,000 accounted for roughly 85 percent of dealer transactions in 2024. Smaller galleries—those with under $250,000 in annual turnover—reported a 17 percent increase in sales. The report also confirmed steady growth in the sub-$5,000 range, mirroring Artprice’s recent data showing a rise in transactions under $10,000. Hiscox’s 2024 Online Art Trade Report found that 60 percent of online buyers purchased works under $5,000, with the fastest-growing bracket under $1,000. At the fair level—from NADA Miami and Untitled Art, which just closed, to Independent New York and Future Fair—small-format works were often among the first to sell out, frequently within VIP day, as both younger and seasoned collectors favored accessible entry points that fit urban apartments.

The design world is echoing the same preference. Artsy identified the rise of “gallery wall” and salon-style décor as a key trend, with interiors favoring densely hung arrangements of small pieces over single statement works. Publications from Elle Decor to The New York Times have likewise pointed to small-format art as the next major wave in collecting—easier to buy, easier to place and uncannily suited to the economic and spatial realities of 2025.

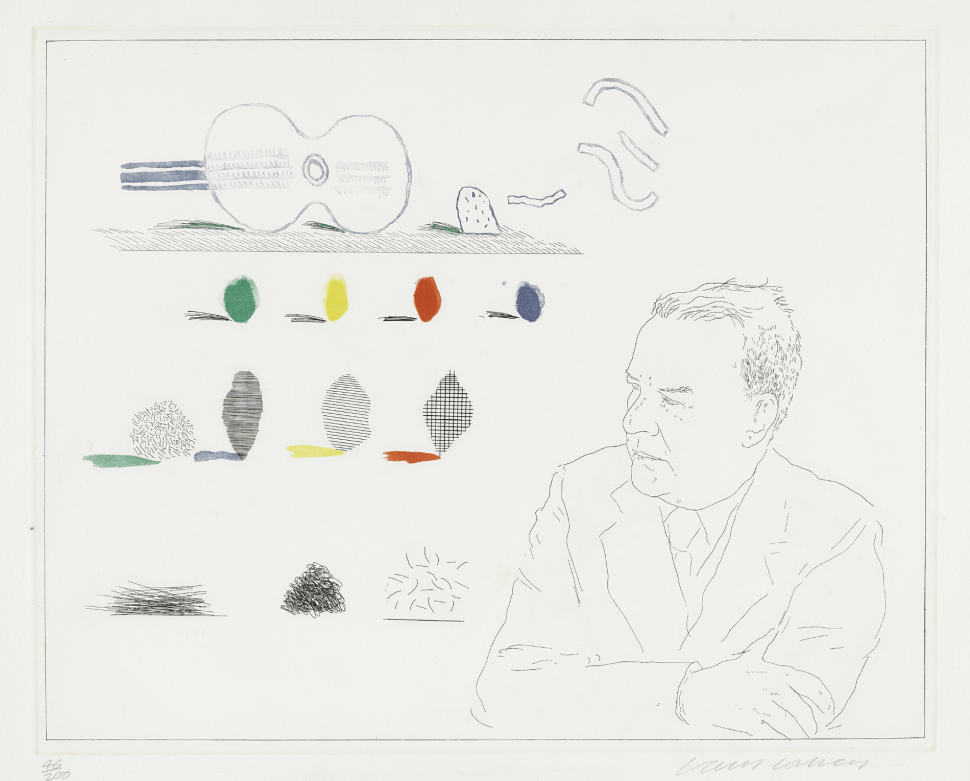

As collectors lean toward more affordable, manageable formats, editions and drawings are also gaining popularity, particularly for those who want to access established and blue-chip names otherwise out of reach. Artsy’s report dedicates a spotlight to David Hockney, who, after a few landmark years of museum shows, saw a spike in demand not only for paintings but also for prints available at more accessible price points. Searches for his name were up 46 percent on Artsy in 2025, making him the third most searched artist on the platform, with strong demand for his more “popular-priced” etchings.

Trend 2: Blue’s growing appeal

In a time of uncertainty and global turmoil, collectors have been turning toward the calming psychological pull of blue. Searches for “blue” on Artsy were up 20 percent year over year, with a particular preference for cobalt, a deep, vivid shade. Searches for “cobalt” rose 131 percent year over year, while purchases tagged “bright and vivid colors” increased 22 percent.

As water becomes more precious and record-hot summers force us to reckon with its growing scarcity, blue has gained traction for its association with water. Works depicting swimming pools, waves and open seas have seen growing interest, with searches for “ocean,” “sea” and “water” rising by 33 percent, 28 percent and 24 percent, respectively. This trend has been visible at fairs over the past few years and in the auction market—most notably with Yves Klein’s California (IKB 71) (1961), a monumental museum-grade masterpiece that sold for €18.37 million ($21.34 million) at Christie’s Paris in October.

But the blue trend extends well beyond the art world. Pantone’s Spring 2025 palette featured multiple saturated blues, with Strong Blue among its most circulated seasonal shades. Vogue declared cobalt the “new it-color,” as designers Tommy Hilfiger and Loewe leaned into deep blues in their spring/summer 2025 runway shows. Miu Miu, Balenciaga and Ferragamo pushed electric and ultramarine blues in recent campaigns, while beauty and consumer culture followed suit: Glossier and Rare Beauty launched cobalt liners, Dyson released cobalt-violet appliances that became TikTok fixtures and Apple’s deep-blue iPhone finish emerged as the most ordered shade of its cycle.

Trend 3: A return to nature

This widespread desire to disconnect and return to the essence has also fueled a renewed longing for nature—something many rediscovered during the pandemic. This “bucolic escapism,” a contemporary take on the idyll, has taken hold in gallery shows and fair presentations through dreamy landscapes, rolling hillsides, lush gardens and flower compositions, as well as scenes of horses.

Art history offers precedent: renewed fascination with pastoral imagery tends to surface during moments of political fatigue or cultural volatility. In Ancient Rome, pastoral ideals emerged amid expansion, civil war and social anxiety, as poets and painters projected fantasies of rustic simplicity—Virgil’s Arcadia being the archetype. After the turmoil of the Napoleonic era, European painters embraced a neoclassical pastoral vocabulary as an antidote to upheaval and imperial overreach. The pastoral has long served as a stabilizing fiction—a world governed by harmony rather than conflict, by timeless nature rather than chaotic politics. Today’s appetite for harmonious landscapes, garden scenes and atmospheric horizons reflects similar pressures: climate dread, digital overload and geopolitical tension.

On Artsy, purchases of works tagged “landscapes and waterscapes” were up 35 percent year over year, “flora” up 44 percent and “earth tones” up 29 percent. Searches for related topics also accelerated: “picnic” rose 208 percent, “outdoors” 80 percent, “nature” 30 percent and “landscapes” 19 percent.

Once again, the trend extends beyond the art world, with organic, nature-inspired shapes, earth tones and natural light dominating collectible design and interiors—fueling continued momentum for the Lalannes—and echoing lifestyle culture more broadly. Biophilic design, from indoor gardens to moss-green upholstery and stone surfaces, has become a recurring feature in architecture and retail, while fashion and wellness brands lean into materials and palettes that promise grounding and retreat in an increasingly unstable, urbanized world. Pinterest’s 2025 summer trend report highlighted a sharp rise in nature-oriented searches tied to the “digital detox” narrative. Airbnb reported a 100 percent increase in searches for countryside stays and a 50 percent rise for national park stays, with Gen Z driving a 26 percent surge in fall travel searches—Vermont ranked as a top foliage destination. TripAdvisor and other booking data indicate that smaller, nature-adjacent cities are outperforming major metropolitan destinations, and the U.S. National Park System logged roughly 332 million visits in 2024, confirming that nature-based travel and outdoor engagement have become defining trends of 2025.

Trend 4: The return of domestic tableus

With the pandemic, for better or worse, people rediscovered the pleasures of staying home, reviving interest in domestic rituals such as cooking and shared meals. Unsurprisingly, the final key trend Artsy identified is the rising popularity of still lifes that depict this comforting domesticity, along with scenes of people eating together. Purchases of works tagged “food” were up 61 percent year over year, while searches for “dinner” and “food” each rose 44 percent, “dining” 38 percent, “meal” 28 percent and “table” 18 percent.

Once again, the trend extends across lifestyle and communication. Etsy reported that searches for “dining ware” and “supper club,” driven by table-setting categories, surged by 1,000 percent. Social platforms are flooded with cooking tutorials, dinner-party events and images of dining—often at home. On TikTok, “dinner parties” content views were up 70 percent year over year and #CookingTok remained one of the most active tags, while on Instagram, posts tagged #tablescape increased over 35 percent. On YouTube, cooking videos saw a 25 percent increase in watch time, and Eventbrite reported a 45 percent rise in cooking-class bookings in 2024-2025. As eating out becomes more expensive and people feel more disconnected and alienated, the rediscovery of cooking and sharing food reflects a contemporary nostalgia as much as a desire to reconnect with the essence—what truly nourishes body and soul.

Now, if we think of art as both symptom and palliative, these buying patterns begin to read as something larger than market behavior. They reveal a broader societal undercurrent—a map of what people are seeking, avoiding or trying to soothe. In this sense, what collectors gravitate toward becomes a quiet proxy for the contemporary condition, a way of understanding not only what is selling but what people feel they need.

More art market news

-

Lalannes Fever and the Global Demand for Design

-

What Zero 10 Can Tell Us About the Art World’s Next Chapter

-

Sotheby’s Closes Its Inaugural Abu Dhabi Collectors’ Week With $133 Million in Sales

-

Wendi Norris Bet On Women Surrealists—Now the Market Has Caught Up

-

Artificial Intelligence Is Quietly Rewriting the Rules of Art Valuation

Observer

Leave a Reply