As 2026 starts, cracks are appearing in whatever magic has kept California’s housing market intact.

My trusty spreadsheet found affordability woes are spreading, with just a whiff of price drops and homebuying at near-record lows.

The reality is even the least expensive parts of California have become unaffordable for homebuyers.

Ponder affordability data from Attom, which tracks the typical house hunter’s financial challenges dating to 2005 in 36 California counties. By comparing home values, mortgage rates and household incomes, Attom determined the share of income required for a home purchase.

Splitting those 36 counties into three slices helps to show how the homebuying burden has changed from 2025’s fourth quarter to not-so-recent lows in buying’s financial burden – a decade-plus ago, just after the Great Recession slashed prices.

Yes, affordability may be improving in early 2026, but these figures highlight how far affordability has fallen.

First, look at California’s 12 priciest counties where a median 83% of income went toward the fourth-quarter’s $1 million home price. But buying also takes 83% of incomes in the 12 cheapest counties, with a median price of $398,000.

Next, eyeball the stunning change in this financial stress from its bottom.

The median burden in the priciest counties has slightly more than doubled from their low of a 37% share of income.

But that same stress more than quadrupled from a collective low of 20% in California’s cheapest counties.

Coastal California’s affordability hurdles also have spread inland.

Dipping prices

Here’s some modest relief for California house hunters: values were falling in 88% of the state as 2025 ended.

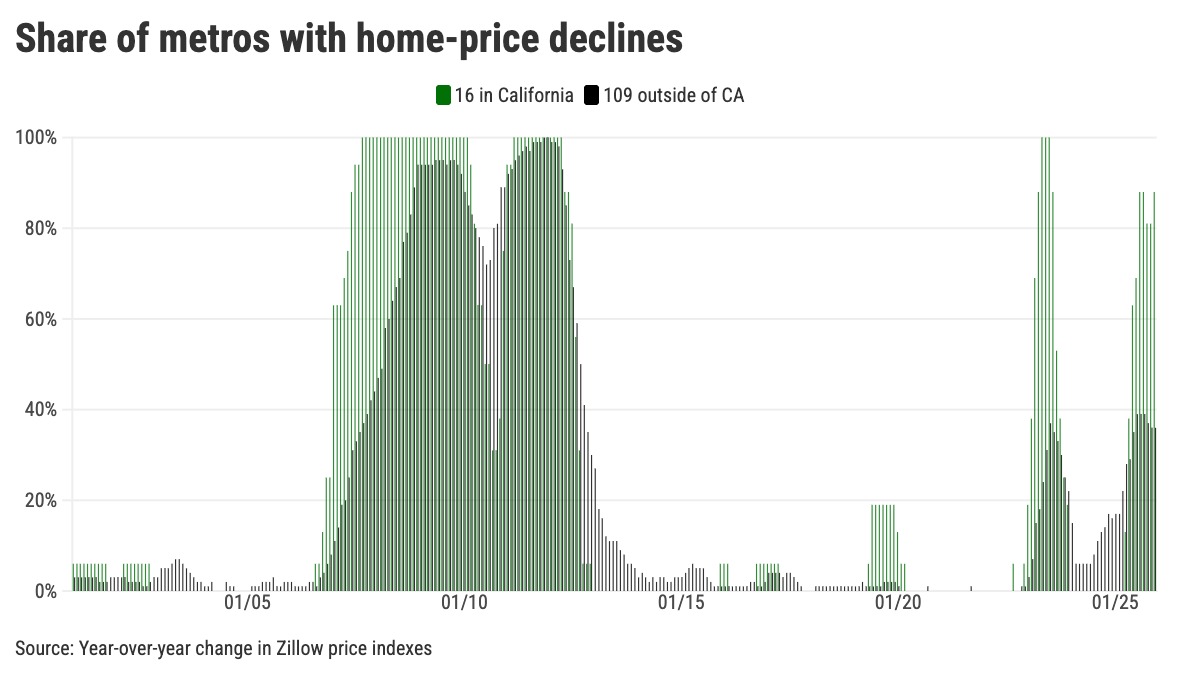

Contemplate home value data from Zillow for 125 of the nation’s largest metropolitan areas, including 16 from California.

In the 12 months ended in December, values were down in 14 of the 16 California metros. But savings were meek, with the largest dip found in Stockton, off only 4% last year vs up 2% in 2024 and 36% over the previous four years.

But seeing declines is noteworthy because, as recently as March 2025, no California metro had falling prices. That was the end of a 14-month streak without any year-over-year decreases.

The late 2025 slips are a reminder that home prices don’t always rise. Zillow values in the 16 California metros combined have dropped year over year in 26% of months since 2000, mostly surrounding the Great Recession.

Compare that to the nation. In the 109 larger metros outside of California, just 39 had price declines – that’s just 36%.

But that, too, is above the national norm. Since 2000, those non-California metros have had declines 22% of the time.

No sale

Is it a major surprise that California’s homebuying pace fell to its second-slowest level for a November in 21 years?

Consider that 23,317 existing and newly built homes — houses and condos — were sold statewide, according to Attom data dating to 2005. This broad tally of sales is down 8% over 12 months and 30% below average.

It’s nothing new. Sales over the past three years averaged 26,428 per month – 31% below the pace of the previous 18 years.

Why? Attom shows California pricing remains stubbornly high.

Its $735,000 statewide median for November was up 0.3% in a year and just 2% below the $751,000 peak set in June 2025.

The good news for California’s house hunters is that appreciation has cooled: Prices are up 9% during the past three years vs. 32% in 2019-2022.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com

The Mercury News

Leave a Reply